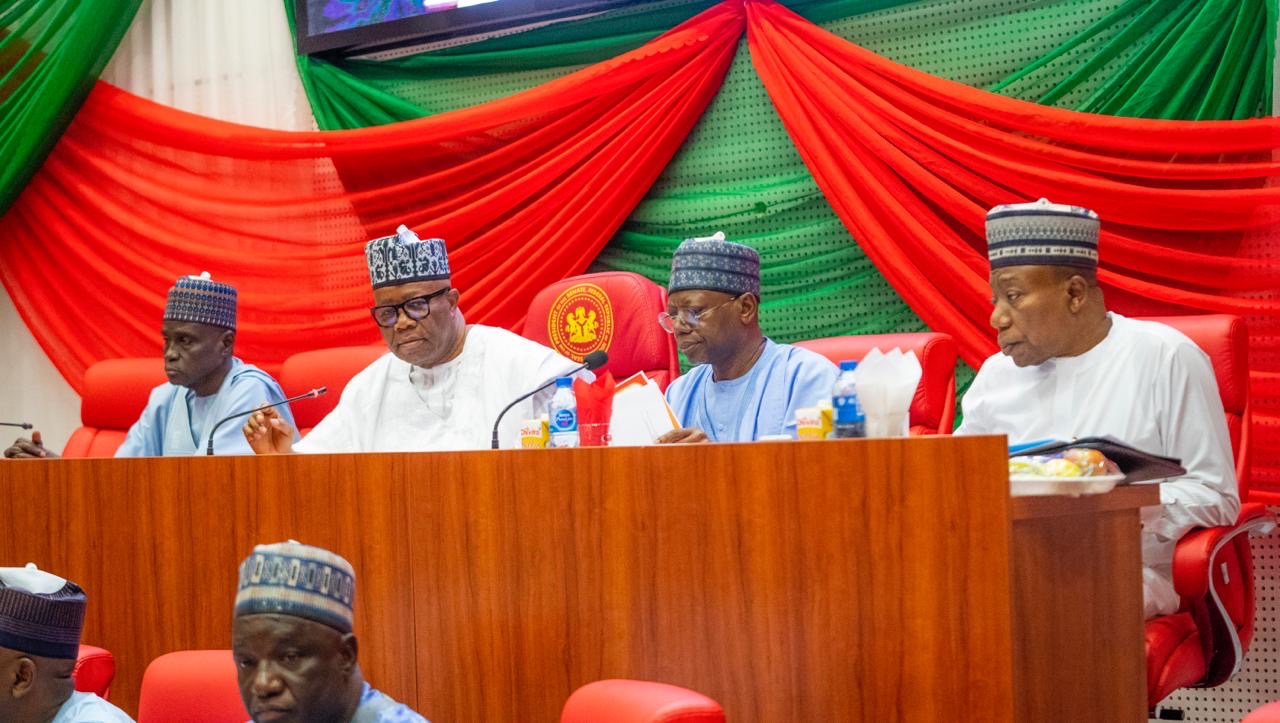

The Senate’s public hearing on the Tax Reform Bills is wrapping up today, Tuesday, February 25. Stakeholders are expected to make their final submissions before the bills move forward in the legislative process.

The two-day hearing, organised by the Senate Committee on Finance, is aimed at gathering expert input on key tax reforms that are intended to enhance revenue generation and improve fiscal management in Nigeria.

On Monday, government officials, industry leaders, and civil society groups presented their views on the Joint Revenue Board Establishment Fund Bill, the Nigerian Revenue Services Bill, the Nigerian Tax Administration Bill, and the Nigerian Tax Bills.

Today’s session is expected to conclude discussions and address any concerns raised, before the proposed legislation is refined and moved to the next stage in the legislative review process.

Senator Sani Musa, the Chair of the Senate Finance Committee, assured that the process would be transparent and, in the nation’s, best interest. He emphasised that the hearing was designed to modernise Nigeria’s tax laws, making them more in line with current economic realities, while also ensuring fairness, inclusivity, and efficiency.

Finance Minister Wale Edun, FIRS Chairman Zacch Adedeji, NNPCL Group CEO Mele Kyari, Customs Comptroller General Adewale Adeniyi, and other key figures are attending the hearing.

Earlier, President Bola Tinubu urged the Senate to provide workable laws from the proposed tax bills. These include the Nigeria Tax Bill 2024, the Nigerian Tax Administration Bill 2024, the Nigeria Revenue Service Establishment Bill 2024, and the Joint Revenue Board Bill 2024.

The President’s request was conveyed by Senator Musa during his remarks at the hearing.

Tax reform has long been a contentious issue in Nigeria, given its potential impact on businesses, the economy, and the public.

The government has frequently proposed tax reforms to boost revenue, reduce dependence on oil, and tackle inefficiencies within the tax system.

In July, President Tinubu approved the creation of a Presidential Committee on Fiscal Policy and Tax Reforms to make it easier to do business in Nigeria.

The Presidency has also denied claims that the tax reforms are aimed solely at benefiting Lagos and Rivers States, stressing that the reforms are intended to improve the overall quality of life for Nigerians by streamlining the tax system.

Trending

Trending