AI giant, Nvidia, hit a landmark by becoming the first company to achieve a $4 trillion market valuation on Wednesday, highlighting Wall Street’s optimism that artificial intelligence will revolutionise the economy.

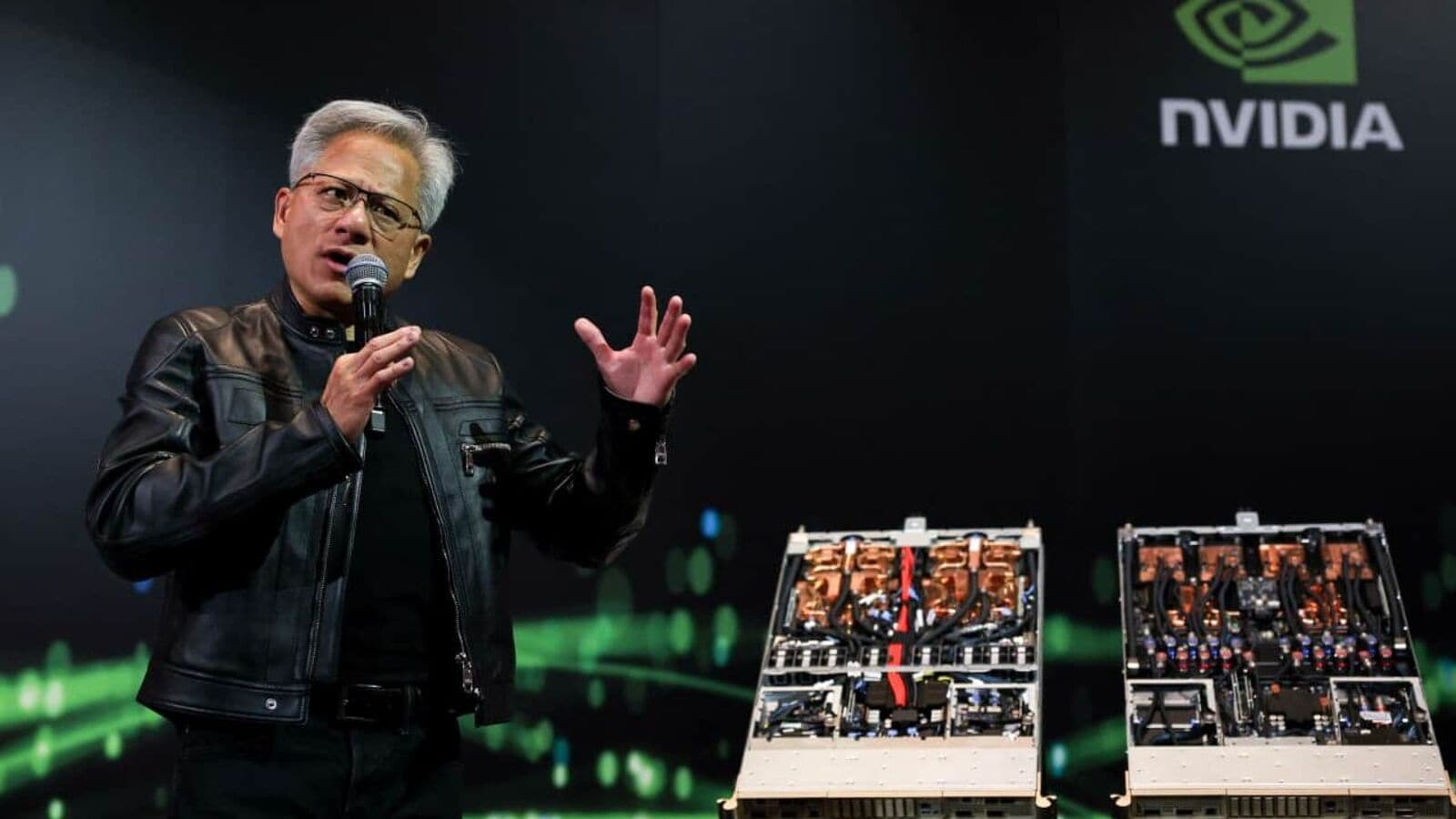

Shortly after the market opened, Nvidia, under the leadership of electrical engineer Jensen Huang, soared to a high of $164.42, momentarily pushing its valuation above $4 trillion before it slightly declined.

The market value of Nvidia now exceeds the GDP of countries like France, the United Kingdom, or India, underscoring the strong investor belief that AI will usher in a new generation of robotics and automation, potentially increasing productivity while also posing challenges to existing industries and businesses.

The recent surge in the California chip manufacturer’s stock is contributing to a broader recovery in the stock market, even as Nvidia itself continues to outperform major stock indices. This is partly due to relief stemming from President Donald Trump’s decision to soften his most extreme tariffs, which adversely affected global markets in early April.

Although Trump has recently rolled out new tariff measures, the S&P 500 and Nasdaq indices have remained close to record highs.

Despite facing US export limitations towards China and broader tariff uncertainties, Nvidia’s agreement to develop AI infrastructure in Saudi Arabia during Trump’s state visit in May indicated that there are potential benefits to be found in Trump’s trade policies.

Nvidia’s climb to a $4 trillion valuation marks a significant milestone in its steady increase over the past two years, as excitement around AI has grown.

In 2025 alone, Nvidia’s stock has increased by 20 per cent, compared to a six per cent gain in the Nasdaq.

Huang, who was born in Taiwan, has impressed investors with a series of innovations, particularly in his main product: graphics processing units (GPUs), which are essential for many generative AI applications across the tech sector, including autonomous vehicles, robotics, and other advanced fields.

The company has also introduced new developments recently, showcasing its Blackwell system, which Huang stated in March would soon allow most productions to be “created and brought to life long before they are physically realised.”

However, Nvidia faced challenges early in 2025 when concerns arose about the Chinese DeepSeek venture, leading to fears that growth in AI investment might decelerate. At that time, the company saw a reduction of around $600 billion in its market value.

Huang of Nvidia has recognised DeepSeek as an emerging player in technology while advocating against US export restrictions.

In the latest quarter, Nvidia reported earnings of nearly $19 billion, despite a $4.5 billion loss attributed to U.S. export restrictions aimed at curbing the sale of advanced technology to China.

The first quarter earnings reports also revealed that the momentum behind AI remained robust across the tech industry. Major technology firms—Microsoft, Google, Amazon, and Meta—are competing fiercely for supremacy in the multi-billion-dollar AI race.

Trending

Trending