The humble pot of jollof rice, a culinary cornerstone in West African households, is rapidly transforming into an unaffordable luxury for many, according to the latest SBM Jollof Index, Q2 2025 report by SBM Intelligence.

The comprehensive assessment reveals a persistent and often dramatic surge in food prices across Nigeria and Ghana, with Nigeria experiencing a particularly “crushing cost” increase.

The Jollof Index, which meticulously tracks the price of ingredients needed to prepare the iconic dish, serves as a crucial barometer for economic pressures faced by families.

SBM Intelligence collects market data monthly, excluding only December to avoid seasonal anomalies, providing a clear picture of underlying market dynamics.

Nigeria’s Jollof Crisis Deepens

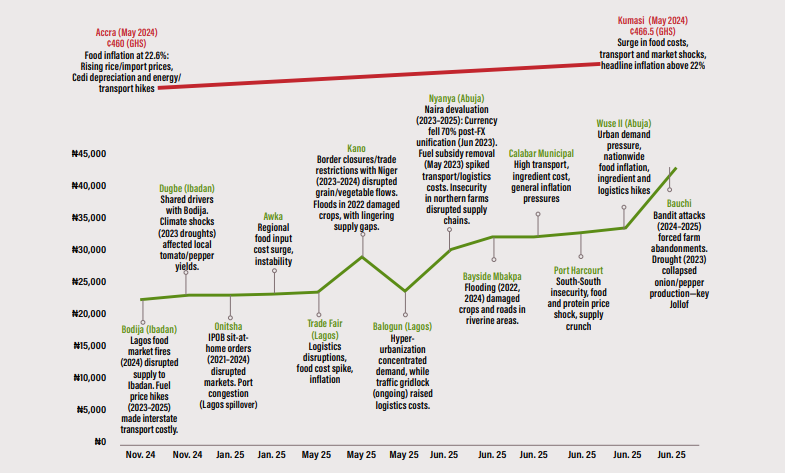

Nigeria’s food inflation trajectory is a cause for grave concern. The national average cost of preparing a pot of Jollof Rice skyrocketed by an astonishing 153% between March 2023 and June 2025, reaching N27,527.85.

This dramatic acceleration has been broad-based, impacting essential ingredients such as proteins, pepper, onions, and vegetable oil.

“The escalating food inflation in Nigeria, strikingly reflected in these figures you have shown me, is profoundly impacting households and businesses, forcing drastic adjustments to daily living,” shared ‘P,’ a mother of three and chef in Lagos, in an exclusive interview with SBM Intelligence.

She highlighted the “back and forth” struggle with clients due to volatile prices and the grim reality of her family of five having to forgo protein or rely on cheaper alternatives, such as eggs, as a kilogram of chicken or turkey is no longer sufficient for a single meal.

Regional disparities paint an even starker picture, with Bauchi, Calabar Municipal, and Wuse emerging as severe inflation hotspots. Bauchi, in particular, witnessed an unprecedented Jollof Index reaching N41,050 by June 2025, a staggering 587% surge since 2016. This is driven by localised factors like bandit attacks, drought impacting onion and pepper production, and general insecurity in farming regions.

The report highlights a concerning decoupling of food inflation from general Consumer Price Index (CPI) trends in Nigeria, pointing to deep-seated supply-side issues.

Factors such as substantial currency devaluation (the naira fell 70% post-FX unification), escalating energy and transport costs due to fuel subsidy removal, and persistent insecurity in food-producing regions are identified as primary drivers.

Ghana’s Volatile but Moderating Landscape

Ghana’s Jollof Index has also trended upwards, albeit with greater volatility and intermittent periods of deceleration. The Ghanaian Index climbed from GH¢277.75 in January 2023 to GH¢420 by June 2025.

Unlike Nigeria, Ghana’s Jollof Index closely mirrors national CPI trends, suggesting that macroeconomic policies and interventions have a more immediate impact on food prices.

Ghana experienced a notable decline in food inflation, dropping from 25% in April to 16.3% by June 2025. This moderation is attributed to a strengthening cedi, improved supply conditions, and effective policy interventions. However, food inflation remains above the national average, indicating ongoing challenges.

The View from the Kitchen: Daily Struggles

The personal accounts within the report underscore the severity of the crisis. ‘P’ from Lagos noted a common market sight: large tubers of yam now being sliced and sold in smaller portions, and fish retailed in quarter or half-kilo quantities, purely for affordability. Even ‘ponmo,’ once a cheap protein alternative, is now significantly more expensive.

For businesses like catering, ingredient substitution is often not an option, leading to client loss. The added burden of an unreliable power supply and the cost of generator fuel further erode profit margins that can’t be passed on to customers.

Call for Urgent Policy Response

The SBM Jollof Index report concludes with an urgent call for coordinated policy responses to combat eroding purchasing power and worsening food insecurity.

For Nigeria, policymakers are urged to prioritise:

- Security in food-producing regions.

- Infrastructure development, particularly road networks.

- Agricultural support and potentially allowing for increased food imports to boost supply.

For Ghana, the recommendation is to sustain macroeconomic stabilisation efforts and invest in productivity enhancements.

For businesses, diversifying sourcing strategies and building resilient supply chains are deemed critical. Ultimately, collaborative action among all stakeholders is deemed essential to building robust food systems and safeguarding food security across West Africa.

Trending

Trending