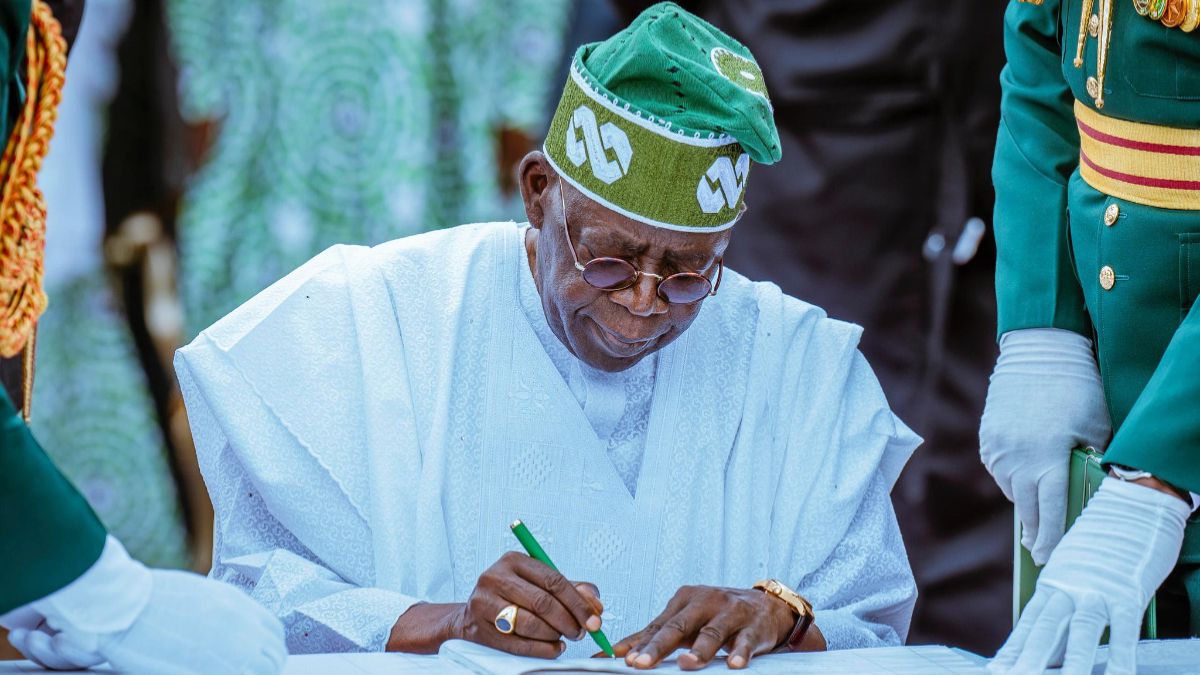

President Bola Tinubu has signed the Nigerian Insurance Industry Reform Bill, 2025, into law on Tuesday.

A statement from Bayo Onanuga, the Special Adviser to the President on Information & Strategy, said that the new law aims to establish comprehensive oversight and regulation for all insurance and reinsurance operations in Nigeria.

The Senate approved the bill in December 2024, followed by the House of Representatives, which passed it in March 2025.

The Insurance Industry Reform Act incorporates a variety of reforms, including a significant increase in the minimum capital requirements for insurance firms.

According to the bill, the new minimum capital requirement for non-life insurance businesses is set at N25 billion, or risk-based capital determined by the National Insurance Commission (NAICOM). For life insurance, the minimum capital is raised to N15 billion, or RBC, as set by NAICOM (previously N8 billion), while the minimum for reinsurance has increased to N45 billion from N20 billion, or RBC, according to the bill.

The risk-based capital mandates insurers to determine their required capital based on the various risks they encounter, including insurance, market, credit, and operational risks.

The new legislation introduces important initiatives, such as strict capital requirements to ensure the financial stability of companies, enforcement of mandatory insurance policies to enhance consumer protection, digitization of the insurance sector to improve access and efficiency, a strict no-tolerance policy for delays in claims processing, the establishment of dedicated funds to protect policyholders, particularly in insolvency cases, and increased involvement in regional insurance initiatives, including the ECOWAS Brown Card System.

According to the statement, the reform introduced by the new law is expected to catalyse new investments, boost consumer confidence, and position Nigeria as a leading insurance hub in Africa.

Trending

Trending