The Democratic Republic of Congo (DRC) will permanently ban cobalt exporters that violate its new quota system, President Felix Tshisekedi has warned, as the world’s top cobalt producer tightens controls to curb fraud and stabilise prices.

Congo, which produces about 70% of global cobalt output, suspended exports in February after prices for the vital electric battery metal fell to a nine-year low.

A quota system based on historical export levels will replace the export ban on October 16, according to Congo’s state minerals regulator, ARECOMS, which announced the plan in September. Under the system, miners will be allowed to ship up to 18,125 metric tons of cobalt for the remainder of 2025, with annual limits of 96,600 tons in both 2026 and 2027.

Minutes from Friday’s cabinet meeting, seen by Reuters over the weekend, revealed that Tshisekedi intends to impose “exemplary sanctions”, including permanent exclusion from the new cobalt regime, on any exporters found violating the system.

The cabinet minutes also confirmed that only ARECOMS has the authority to issue or revoke cobalt export quotas, as well as to decide on all allocation matters.

The earlier export ban, which was extended in June, prompted force majeure declarations from major mining companies including Glencore and China’s CMOC Group. While Glencore, the world’s second-largest cobalt producer, supports the quota system, CMOC, the top producer, has opposed it.

During Friday’s cabinet meeting, Tshisekedi said the export freeze had contributed to a 92% rebound in cobalt prices since March, describing the new system as “a real lever to influence this strategic market” after years of “predatory strategies.”

The enforcement measures come amid ongoing conflict in mineral-rich eastern Congo, where fighting between M23 rebels and the national army has killed thousands and displaced hundreds of thousands of people.

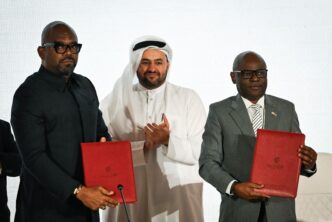

A U.S.-backed peace initiative suffered another setback on Friday after Congo and Rwanda failed to sign a proposed Regional Economic Integration Framework, part of a broader plan aimed at making both nations’ mining sectors more attractive to Western investors.

Trending

Trending