Government external debt repayments are now more than three times higher than they were in 2012, according to S&P’s most recent African sovereign outlook, which was released on Monday.

“We estimate principal external debt repayments of rated African sovereigns at about $90 billion in 2026,” the report said.

“Government external debt repayments are approaching a peak and are now over three times larger than in 2012.”

According to S&P, nearly one-third of the total relates to Egypt, which has “by far the largest debt at about $27 billion,” followed by Angola, South Africa, and Nigeria.

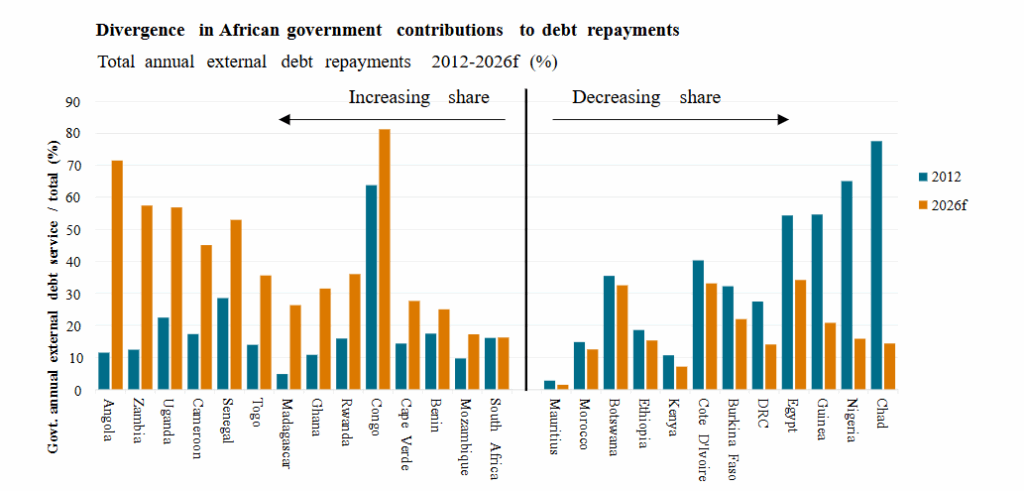

The report noted a wide divergence across the continent in the government share of total annual debt service.

“Large increases in this share typically reflect persistent fiscal deficits and signal heightened government vulnerability to rollover risk and shifts in market sentiment,” S&P said.

“By contrast, a declining government share–aside from cases where external market access is constrained–generally indicates the presence of alternative financing sources, where domestic savings rates and domestic financing are likely more abundant.”

It added that while deeper domestic financial systems can offer governments alternative funding sources, this often comes “at a high cost during periods of higher inflation and, potentially, at the expense of credit to the private sector.”

Beyond debt, S&P indicated security risks and domestic dissatisfaction as additional pressures on public finances.

“The Western and Central African region has seen security conditions deteriorate over recent years, primarily due to the expansion of Islamist insurgencies, particularly in the Sahel, and their spillover into adjacent regions,” the report said.

Among rated African countries, “the most visible increase in long-running insurgency-related violence has occurred in Burkina Faso and (northeastern) Nigeria”, with risks also evident in Benin, Togo, Cameroon, Chad, Cote d’Ivoire, Ghana, and Mozambique.

“Managing the related security risk poses an operational and financial challenge for most governments and could exacerbate the already high spending pressures,” S&P said, noting that the United States launched strikes on Islamist targets in Nigeria in late 2025 following an increase in militant activity.

The agency also pointed to a rise in attempted coups and political unrest.

“The number of attempted coups in the region has also increased, including two in Burkina Faso and one in Benin (which prompted us to revise the positive outlook to stable), Guinea-Bissau (not rated), and Madagascar,” the report said.

In Madagascar’s case, S&P said “increasing dissatisfaction with living pressures prompted ‘Gen-Z’ rioters to overthrow the government.”

It added that similar protests occurred in Kenya in June 2024 over higher taxes proposed under the country’s finance bill.

“In our view, spikes in domestic dissatisfaction have the potential to change fiscal policy, particularly where the inflationary environment and cost-of-living pressures are high and where the government is implementing measures to increase or collect taxes to help raise revenue,” S&P said.

Trending

Trending