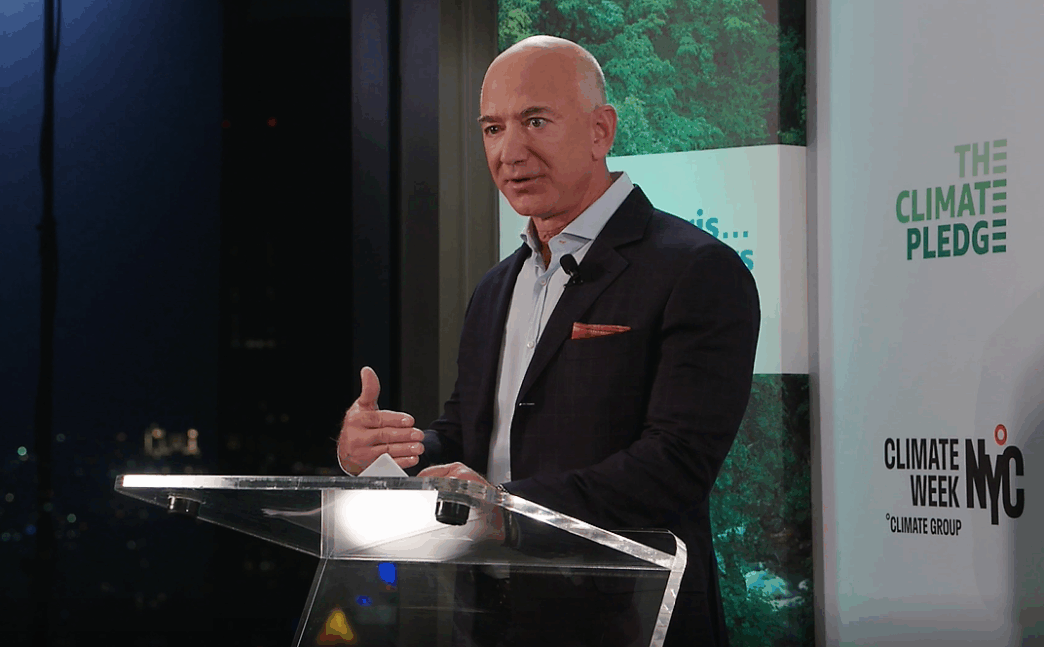

Addressing a crowd of tech professionals and investors, Bezos noted how in times of intense excitement, “every experiment gets funded, every company gets funded — the good ideas and the bad ideas.”

He warned that such a climate makes it difficult for investors to distinguish real value from hype.

Still, he remained firmly bullish on AI’s long-term societal impact. “The benefits to society from AI are going to be gigantic,” he said.

Bezos drew parallels with past technology booms — especially the biotech bubble of the 1990s and the dot-com surge — where many firms failed but crucial innovations endured.

“A lot of companies went out of business and investors lost money … but we did get a couple of lifesaving drugs,” he observed.

In his view, the development currently underway is broader than start-ups chasing shiny ideas. Capital is flooding into the infrastructure behind AI: chip manufacturers, data centres, cloud platforms, and supporting ecosystem firms.

These investments, he argued, have a better chance of staying grounded in value even if some speculative plays collapse.

Bezos also urged patience and perspective during the ups and downs of market cycles. “When the dust settles and you see who are the winners, society benefits from those inventions,” he declared.

His remarks echo a rising chorus of caution from across the tech and financial world. Some executives warn that while AI’s potential is immense, valuations have run ahead of fundamentals—and a correction may be overdue.

Others emphasise that even bubbles with speculative elements can leave long-lasting value by accelerating infrastructure and adoption.

As interest and capital continue to flow into AI, Bezos’s message is clear: the path ahead may be volatile, but the transformation that could follow may be profound — with gains for society that outlast the speculative excess.

Trending

Trending