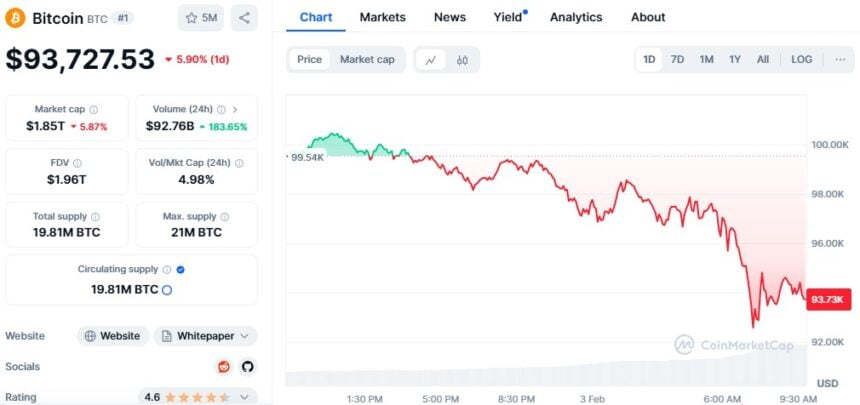

Bitcoin and Ether faced sharp declines on Monday due to escalating global trade tensions. Bitcoin hit a three-week low, falling to $92,580 during early Asian trading, before slightly recovering to $93,727.53.

Ether saw its largest dip since September, plummeting by 24% to $2,300. Bitcoin dropped 7% over the weekend, while Ether fell 20%, reaching its lowest value since November.

The market downturn followed President Donald Trump’s announcement of new tariffs, including 25% duties on Canadian and Mexican imports, and 10% duties on Chinese goods, which will take effect from Tuesday.

The US engages in annual trade worth over $1.6 trillion with these three countries, and the tariffs prompted retaliatory measures from Canada, Mexico, and China, heightening investor uncertainty.

Chris Weston of Pepperstone noted that during times of instability, crypto markets often act as a “risk proxy,” as trade conflicts stir concerns over inflation, corporate performance, and overall market growth.

The crypto market saw $1.79 billion in liquidations within 24 hours of Trump’s tariff announcement, with over 450,000 traders affected. Long positions accounted for $1.57 billion, while short positions amounted to $219 million.

Bitcoin had previously reached a peak of $107,071.86 on January 20, following Trump’s election win, with investors anticipating favourable new crypto regulations. However, the slow pace of regulatory changes has led to disappointing outcomes.

Despite the recent drop, many investors still view Bitcoin as a hedge against inflation and market instability. Financial experts are closely monitoring Bitcoin’s stability around the $90,000 mark, with long-term market performance tied to global economic conditions and trade conflicts.

Trending

Trending