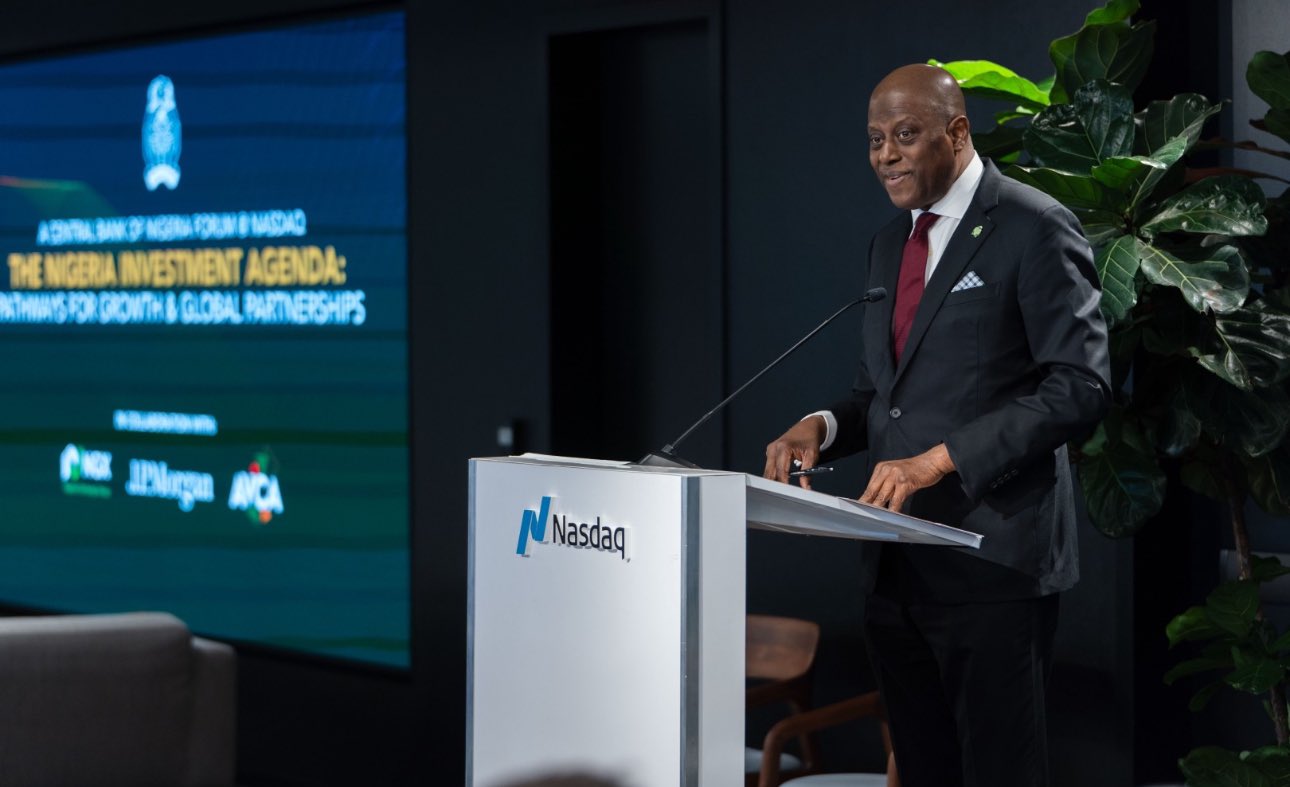

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has called on the country’s fintech leaders to ensure that technological innovation is supported by robust governance, consumer protection, and effective risk management.

Speaking at a strategic session with fintech CEOs on the sidelines of the 2025 IMF/World Bank Annual Meetings in Washington, Cardoso highlighted the importance of maintaining trust in Nigeria’s financial system as the sector continues to evolve.

“As we embrace new technology, it is our responsibility to uphold the integrity of the financial system — maintaining strong governance, consumer protection, and risk management so that trust in our institutions remains firm,” he said.

The session, titled “Shaping the Future of Fintech in Nigeria: Innovation, Inclusion, and Integrity,” brought together fintech founders, investors, regulators, and policy leaders from across the nation.

The forum provided a platform for open dialogue on industry trends, challenges, and policy frameworks that balance innovation with financial stability.

Cardoso stressed that collaboration between the CBN and fintech stakeholders is essential for developing policies that support sustainable growth while safeguarding consumers.

The discussion focused on key areas including innovation and responsible growth, infrastructure and interoperability, legal and policy enablement, and financial compliance.

The CBN governor also reassured foreign investors of Nigeria’s commitment to stabilising the financial system and creating a conducive investment climate.

He pointed to the rise in external reserves as evidence of growing economic resilience and confidence in the country’s financial model.

The session concluded with a commitment from both the CBN and fintech leaders to maintain ongoing engagement, ensuring that regulatory reforms keep pace with the sector’s rapid development while protecting market integrity.

This initiative reflects Nigeria’s efforts to position itself as a hub for fintech innovation in Africa, balancing technological advancement with the trust and security necessary for long-term growth.

Trending

Trending