The Central Bank of Nigeria (CBN) has announced a fresh strategy to widen credit access for smallholder farmers and fast-track efforts towards national food security.

The apex bank presented the national food expansion agenda during the launch of the Agricultural Credit Guarantee Scheme Fund (ACGSF) in Abuja on Tuesday.

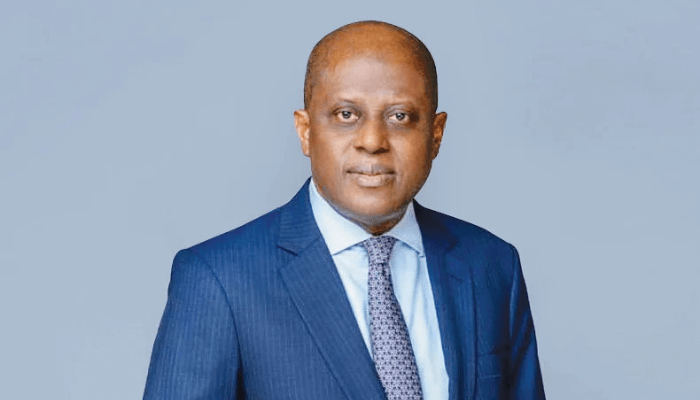

At the inauguration of the reconstituted ACGSF Board, CBN Governor, Olayemi Cardoso, described the initiative as “a new dawn” for agricultural financing. He said the move aligns with the Federal Government’s renewed drive to reposition agriculture as a catalyst for inclusive growth, rural development, and economic diversification.

Cardoso stated that since its establishment in 1977, the ACGSF has remained one of the country’s most effective development finance instruments. However, despite employing nearly two-thirds of Nigeria’s workforce and contributing over 20 per cent to GDP, agriculture still receives less than five per cent of total bank lending—a gap that has stifled millions of farmers for decades.

Credit: Channels TV.

He noted that agriculture has evolved beyond subsistence farming to value-chain driven production shaped by technology, climate risks, and a rising agritech sector. To meet current realities, he said the Scheme must transform into a data-driven institution capable of supporting modern farming.

Cardoso highlighted the 2019 amendment that raised the Scheme’s share capital from N3 billion to N50 billion and expanded its mandate. A key improvement, he added, is the inclusion of farmers’ representatives on the Board, ensuring policies reflect real sector needs.

He stressed that the core aim of the reform is to unlock affordable credit for smallholder farmers, who produce 90 per cent of the nation’s food yet remain financially underserved due to low collateral and weak access to credit.

The Governor urged the Board, led by Dr Olusegun Oshin, to develop products for women, young people, and other marginalised groups, while partnering with fintech firms, microfinance banks, and cooperatives for innovative lending channels. He also recommended the use of technology such as satellite imaging and digital dashboards to monitor loan use and track impact effectively.

Trending

Trending