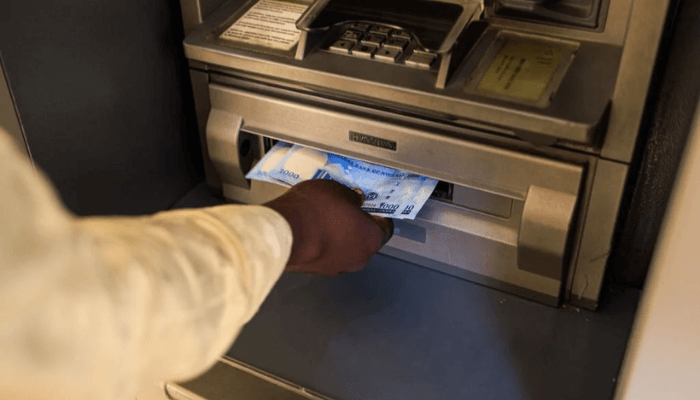

The Federal Competition and Consumer Protection Commission (FCCPC) has praised the Central Bank of Nigeria (CBN) for its proposed directive requiring banks to refund customers for failed Automated Teller Machine (ATM) transactions within 48 hours.

In a statement issued on Monday and signed by the Director of Corporate Affairs, Ondaje Ijagwu, the FCCPC described the CBN’s Draft Guidelines on the Operations of Automated Teller Machines in Nigeria as a timely and long-awaited intervention aligned with ongoing efforts to strengthen consumer protection in the financial sector.

The CBN’s draft guideline follows the FCCPC’s Consumer Complaints Data Report released in September 2025, which revealed that the banking and fintech industries accounted for the largest share of consumer grievances nationwide. Between March and August 2025, the FCCPC recorded over 3,000 complaints against banks and facilitated the recovery of about ₦10 billion for consumers across 30 sectors.

According to the Commission, the new policy directly addresses recurring problems such as failed transactions, unauthorised deductions, and prolonged refund delays.

The FCCPC’s Executive Vice Chairman and CEO, Tunji Bello, lauded the CBN’s move as “a timely and long-awaited correction to a persistent consumer challenge,” commending it as consistent with the Commission’s long-standing advocacy.

“We commend the CBN for this decisive step, which will ease the burden on consumers and rebuild trust in financial services,” Bello stated, noting that the initiative also signals stronger coordination among regulatory bodies.

The FCCPC further highlighted that the CBN’s proposal aligns with Sections 17(g), (h), (l), (s), and (t) of the Federal Competition and Consumer Protection Act (2018), which empower the Commission to eliminate unfair practices, promote fair dealings, resolve consumer complaints, and ensure the reliability of goods and services.

The Commission urged the prompt adoption and enforcement of the CBN directive, stressing that early implementation would offer immediate relief to consumers facing unresolved electronic transaction issues. It also announced plans to collaborate with the CBN on a joint monitoring framework to track banks’ compliance with the 48-hour refund rule.

Under the proposed guidelines, customers are required to first report transaction issues to their banks or the CBN. If unresolved, complaints can be escalated to the FCCPC through its Complaints Portal (complaints.fccpc.gov.ng), email ([email protected]), or hotline (0805 600 2020).

Nigeria’s electronic payment ecosystem now serves over 200 million cardholders, but persistent network failures and refund delays have continued to erode public confidence. The new guidelines — arriving just eight months after the CBN’s review of ATM fees — aim to streamline service delivery, enhance consumer trust, and improve accountability within the banking sector.

Stakeholders have been invited to submit feedback, with the policy expected to take effect before the end of 2025.

Trending

Trending