Meta delivered impressive financial results for the second quarter, with a 22 percent year-on-year revenue increase to $47.5 billion, driven largely by a surge in advertising and the company’s continued commitment to artificial intelligence. The announcement on Wednesday sent its share price climbing by up to 12 percent in after-hours trading.

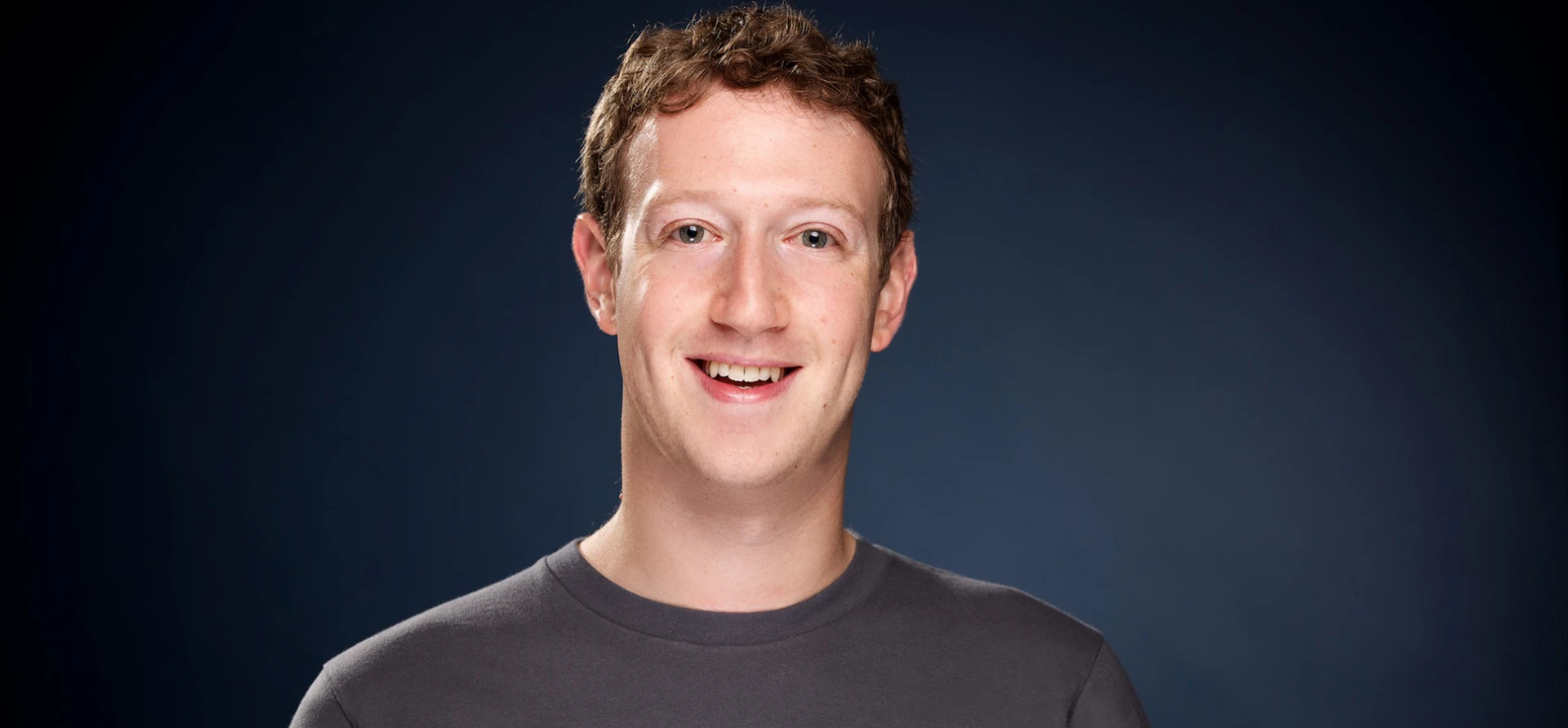

CEO Mark Zuckerberg hailed the results as a reflection of both commercial and community growth. “We’ve had a strong quarter both in terms of our business and community,” he said, adding that he was “excited to build personal superintelligence for everyone in the world.”

The social media giant, which owns Facebook, Instagram, WhatsApp, and Messenger, recorded a net profit of $18.3 billion, up from $13.5 billion a year ago. Advertising revenue alone jumped 21 percent to $46.6 billion, significantly contributing to the upbeat earnings. Daily active users across Meta’s platforms reached 3.48 billion in June, a 6 percent increase compared to the same period last year.

Meta’s capital expenditure surged to $17 billion during the quarter, largely directed toward building AI infrastructure. The company now expects to spend between $66 billion and $72 billion on capital investment in 2025, underscoring its aggressive AI ambitions.

Zuckerberg has been courting leading talent from AI rivals such as OpenAI and Apple, aiming to lead the race for superintelligence. “To win the superintelligence race requires the best of the best talent, and Meta’s been on a roll when it comes to recruiting top AI talent. Money talks and Meta has plenty of it,” said Mike Proulx, research director at Forrester.

Yet, some analysts have warned that Meta’s vast AI spending needs clearer direction. While the current financial performance gives Zuckerberg more leeway with investors, questions remain over the long-term viability of such an approach. “Capital expenditures are still shockingly high, but with these strong results, Meta has bought itself more time with investors,” said Debra Aho Williamson from Sonata Insights.

Others expressed concern that the AI push could repeat past missteps, referencing Zuckerberg’s costly bet on virtual reality and the metaverse, which prompted the company’s rebranding from Facebook to Meta. That initiative continues to bleed money, with the Reality Labs division posting a $4.5 billion loss on just $370 million in revenue this quarter.

Nonetheless, Meta is pressing ahead. Its AI strategy is led by Alexandr Wang, formerly CEO of Scale AI, in which Meta invested $14.3 billion. Zuckerberg maintains that achieving AI superintelligence is now “in sight,” calling the rest of the decade a pivotal era for technological transformation.

“There’s no other company that is as good as us at taking something and getting it in front of billions of people,” Zuckerberg told analysts, reinforcing Meta’s commitment to integrating AI into everyday user experiences.

Trending

Trending