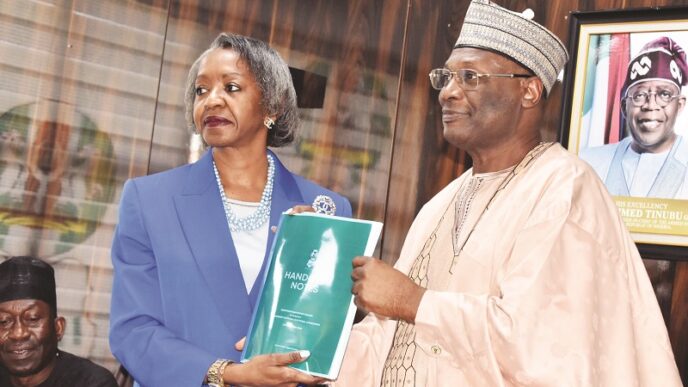

President Bola Tinubu has asked the House of Representatives to approve a $2.35 billion external loan to help finance part of the 2025 budget deficit and refinance Nigeria’s maturing Eurobonds.

The request, contained in a letter to Speaker Tajudeen Abbas and read on the House floor on Tuesday, also seeks parliamentary approval to issue a $500 million debut sovereign sukuk on the International Capital Market (ICM) to fund infrastructure projects and broaden Nigeria’s financing options.

Tinubu explained that the borrowing plan is in line with Sections 21(1) and 27(1) of the Debt Management Office (Establishment) Act, 2003, which require legislative consent for new loans and refinancing initiatives.

The proposed borrowing includes $1.23 billion (₦1.84 trillion) to partly fund the 2025 budget deficit and $1.12 billion to refinance a Eurobond maturing on 21 November.

Highlighting past successes of sukuk issuances, Tinubu noted that between September 2017 and May 2025, the Debt Management Office (DMO) raised ₦1.39 trillion in the domestic market to support major road projects. He stressed the need to attract external funding to complement domestic resources and bridge infrastructure financing gaps.

The government intends to raise the funds through instruments such as Eurobonds, loan syndications, or bridge financing facilities, depending on market conditions. Tinubu added that the pricing of the new Eurobonds is expected to align with yields on Nigeria’s existing bonds, currently between 6.8% and 9.3% based on maturity.

On the proposed $500 million sukuk, the President said the initiative would help diversify Nigeria’s investor base, deepen the government securities market, and support critical infrastructure development nationwide.

Trending

Trending