President Donald Trump announced on Tuesday night that Venezuela will hand over between 30 million and 50 million barrels of oil to the United States, with the crude to be sold at prevailing market prices and the proceeds placed under US control.

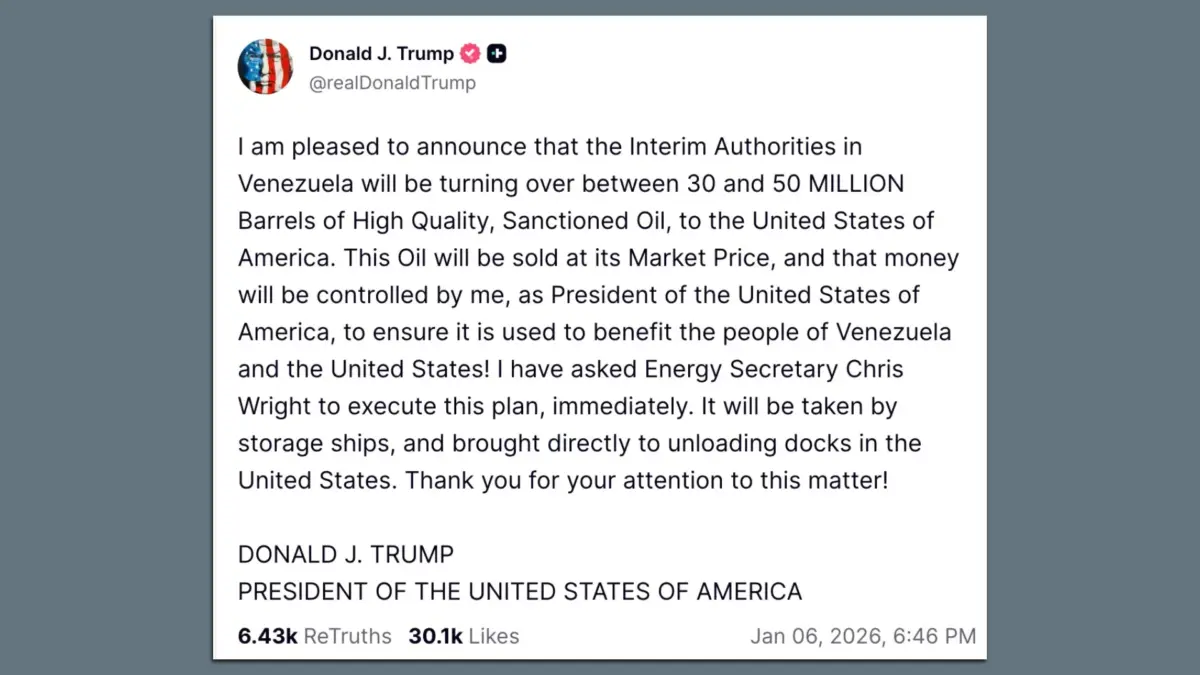

In a post on Truth Social, Trump said Venezuela’s interim authorities would transfer what he described as “sanctioned oil” to the United States.

The funds generated from the sale, he added, would be used “to benefit the people of Venezuela and the United States!”

Trump also disclosed that Energy Secretary Chris Wright has been instructed to “execute this plan, immediately,” noting that the oil “will be taken by storage ships, and brought directly to unloading docks in the United States.”

A senior administration official, who spoke to CNN on condition of anonymity, said the oil has already been produced and stored in barrels. According to the official, most of the crude is currently loaded on vessels and will now be redirected to US facilities along the Gulf Coast for refining.

While the proposed transfer of 30 to 50 million barrels appears substantial, it represents only a fraction of US demand. The United States has consumed slightly more than 20 million barrels of oil per day over the past month.

As a result, the move may exert limited downward pressure on oil prices and is unlikely to significantly reduce petrol costs for American consumers. By comparison, former President Joe Biden authorised the release of about 180 million barrels from the US Strategic Petroleum Reserve in 2022 — roughly four to six times the volume now proposed — a move that cut pump prices by only 13 to 31 cents per gallon over four months, according to a Treasury Department analysis.

Oil markets reacted swiftly to Trump’s announcement, with US crude falling by about $1 a barrel, or just under 2%, to $56 shortly after the post appeared on Truth Social.

The potential sale could, however, generate sizeable revenue. With Venezuelan crude currently trading at around $55 per barrel, selling up to 50 million barrels could raise between $1.65 billion and $2.75 billion, provided buyers are willing to pay market rates.

Venezuela has accumulated large stockpiles of crude since the United States imposed an oil embargo late last year. However, transferring such volumes to the US could significantly draw down the country’s own reserves.

The oil is expected to come from a combination of onshore storage facilities and seized tankers that had been transporting crude. Phil Flynn, senior market analyst at Price Futures Group, said Venezuela has roughly 48 million barrels of storage capacity and was close to full. Industry estimates also put the volume carried by tankers at between 15 million and 22 million barrels.

It remains unclear over what timeframe the oil will be delivered to the United States.

The senior administration official said the transfer would take place rapidly, arguing that Venezuela’s crude is extremely heavy and cannot be stored for extended periods.

However, Andrew Lipow, president of Lipow Oil Associates, disputed the urgency, noting in a written comment that crude oil does not spoil if left unrefined. “It has sat underground for hundreds of millions of years. In fact, much of the oil in the Strategic Petroleum Reserve has been around for decades,” he wrote.

Trending

Trending