Warner Bros. Discovery has rejected a hostile takeover approach from Paramount, reaffirming its commitment to a proposed merger with streaming giant Netflix. The company said on Wednesday that Netflix’s offer provided greater certainty and value for shareholders than the rival bid unveiled last week.

In a statement, Warner Bros said Paramount’s proposal failed to resolve longstanding concerns despite multiple previous approaches. The company noted that it had reviewed six earlier proposals from Paramount and said the latest bid once again did not address key issues that had already been raised during those discussions. Warner Bros added that it was confident the Netflix deal represented a stronger and more reliable outcome for investors.

Netflix sent shockwaves through the entertainment industry on December 5 when it announced it had reached an agreement to acquire Warner Bros’ film and television studios, along with the HBO Max streaming service, in a deal worth close to $83 billion. If completed, it would be the largest consolidation in the sector in more than a decade.

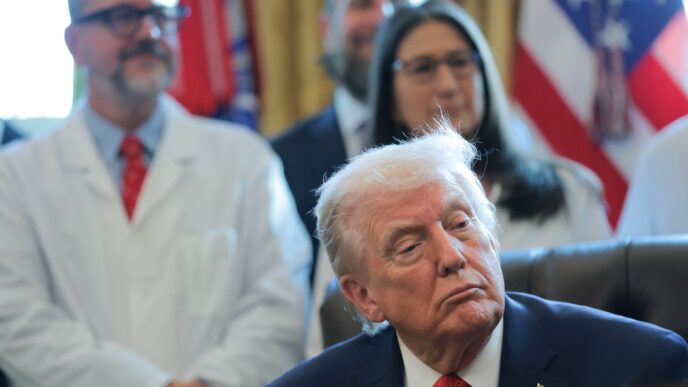

Just days later, Paramount launched an all-cash tender offer valuing Warner Bros. Discovery at $108.4 billion. Paramount is led by chief executive David Ellison, the son of Oracle founder Larry Ellison, who is known to be an ally of US President Donald Trump. However, Warner Bros described the Paramount bid as high-risk, citing concerns over its financing structure, which it said relied on an “unknown and opaque revocable trust” and lacked any direct financial commitment from the Ellison family.

The company also highlighted that around $24 billion of the proposed funding would come from Middle Eastern sovereign wealth funds, a factor that it said would invite additional regulatory scrutiny. By contrast, Warner Bros stressed that the Netflix agreement was backed by committed debt financing from established institutions, offering a cleaner and more predictable structure.

Netflix co-chief executives Ted Sarandos and Greg Peters echoed that position in a letter to Warner Bros shareholders, saying the deal involved no contingencies, no foreign sovereign wealth funds and no reliance on stock collateral or personal loans.

President Trump has repeatedly commented on the bidding battle, warning that a Netflix takeover could be problematic due to the streaming company’s growing dominance in film and television. He has also said he wants to ensure CNN changes ownership as part of any sale of Warner Bros. Discovery, continuing his long-running criticism of the news network.

Paramount’s bid briefly drew support from Affinity Partners, the Middle East-backed private equity firm run by Trump’s son-in-law Jared Kushner, though the firm confirmed on Tuesday that it had withdrawn from the deal. Despite that, Affinity Partners said it still believed there was a strong strategic case for Paramount’s offer.

Unlike Netflix’s proposal, Paramount’s bid included the acquisition of Warner Bros’ cable channels such as CNN, TNT, TBS and Discovery, which would have been added to its existing television portfolio including CBS, MTV and Comedy Central.

As Netflix has emerged as the frontrunner to secure Warner Bros, opposition has grown within parts of Hollywood’s establishment. The streaming platform is often viewed with suspicion in traditional film circles due to its limited emphasis on theatrical releases and its role in reshaping long-standing industry models.

Speaking in Paris on Tuesday, Sarandos sought to reassure critics by saying Netflix would continue to release Warner Bros films in cinemas if the takeover goes ahead. He said the studio would operate independently and follow traditional theatrical distribution practices, while acknowledging that his past remarks on cinema releases may have caused confusion.

Trending

Trending