The Federal Reserve’s decision to hold interest rates steady is now facing scrutiny after a new report revealed a weaker-than-expected labour market.

Just two days after the Fed announced its “wait-and-see” approach on Wednesday, the Labour Department released data showing that the U.S. economy added only 73,000 jobs in July, a number far below what is needed to keep pace with population growth.

The report was even more concerning due to significant downward revisions of job gains for May and June, which combined to show the weakest three-month period of job growth since 2009 (excluding the 2020 pandemic recession). The unemployment rate also rose slightly to 4.2%.

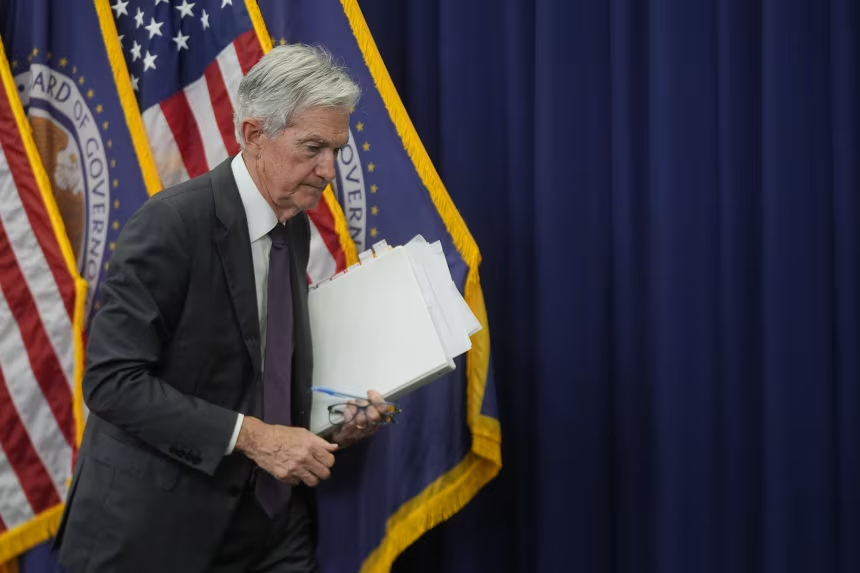

Before the jobs report, Fed Chair Jerome Powell had justified the decision to hold rates by pointing to a “solid” labour market.

However, Jamie Cox, a managing partner at Harris Financial Group, commented that “Powell is going to regret holding rates steady this week.”

Not all Fed officials agreed with the decision. Governors Christopher Waller and Michelle Bowman cast dissenting votes, the first time two governors have done so since 1993.

Both cited signs of weakness in the labour market as a primary reason for their dissent, downplaying concerns about President Donald Trump’s tariffs.

Bowman stated that the labour market has become “less dynamic and shows increasing signs of fragility.”

Despite the weak report, Cleveland Fed President Beth Hammack defended the central bank’s decision, telling Bloomberg that “we try not to make too much out of any one individual report.”

The Fed has faced similar situations before.

Last year, after a quick rise in unemployment sparked calls for rate cuts, the central bank responded with a significant half-point cut, and the labour market subsequently rebounded with strong job growth in December.

Trending

Trending